Trick Steps to Accomplish Success With Effective Offshore Company Development

When starting offshore business formation, selecting the ideal territory is vital. Elements such as political security, economic environment, and legal frameworks play critical functions in this decision-making procedure. Navigating these intricate territories needs a mix of complete research study and professional guidance to guarantee compliance and enhance tax advantages. Recognizing these fundamental steps not only establishes the stage for successful worldwide growth yet additionally highlights the intricate dancing between danger and incentive in global organization.

Selecting the Optimal Territory for Your Offshore Service

When establishing an offshore service, selecting the appropriate territory is important. A steady political environment ensures that the business procedures are not jeopardized by regional turmoils (Offshore Business Formation).

Tax performance also plays a considerable duty in jurisdiction option. Many offshore areas offer tax motivations to attract international investment, which can dramatically reduce a business's economic worries. Nevertheless, the advantages of reduced tax obligations ought to be weighed against the possibility for global scrutiny and compliance issues.

Last but not least, the top quality of lawful framework can influence organization procedures. Territories with strong lawful systems supply much better security for intellectual building, more clear agreement enforcement, and a lot more efficient conflict resolution mechanisms. Entrepreneurs need to extensively study and examine these elements to ensure their offshore endeavor is constructed on a solid foundation.

Browsing Lawful and Regulative Frameworks

After selecting a proper territory, companies have to vigilantly browse the complicated lawful and governing frameworks that regulate their procedures offshore. This job includes understanding and abiding by a broad array of regulations that can vary substantially from one nation to an additional. Key areas often consist of corporate administration, employment laws, personal privacy policies, and industry-specific conformity requirements.

This competence is critical for establishing up frameworks that are not just certified however also optimized for the operational goals of the company. Keeping a nimble method to regulative conformity is important for any type of organization intending to maintain its overseas operations effectively.

Leveraging Tax Obligation Advantages in Offshore Jurisdictions

Among the most compelling factors for organizations to develop procedures in offshore jurisdictions is the capacity for significant tax advantages. These areas frequently have reduced tax obligation rates compared to onshore territories, making them eye-catching locations for business looking to enhance productivity with tax savings. Offshore economic facilities usually provide incentives such as no resources gains tax, no inheritance tax, and lowered business tax prices. This can be especially advantageous for international corporations looking for to minimize their global tax obligation obligations legitimately.

Moreover, the opportunity of deferring taxes by holding earnings within the offshore business permits companies to reinvest their revenues into increasing operations or study and development, additionally fueling growth and advancement. It is essential for business to browse these advantages within the lawful frameworks and international tax conformity requirements to avoid repercussions such as fines and reputational damages. Using these tax frameworks efficiently can result in substantial lasting economic advantages for businesses.

Performing Thorough Due Persistance

While discovering the potential tax obligation benefits of offshore jurisdictions, organizations have to additionally prioritize conducting detailed due diligence. This procedure is critical in identifying legal, financial, and operational risks connected with offshore business operations. Firms need to meticulously investigate the regulatory environment of the chosen territory to make certain conformity with both neighborhood and worldwide laws. Offshore Business Formation. This consists of recognizing tax obligation responsibilities, company registration requirements, and any kind of prospective economic sanctions or anti-money laundering laws.

Examining political security and financial conditions within the jurisdiction additionally creates an important component of due diligence. Such evaluations aid in projecting potential difficulties and sustainability of the service setting, guaranteeing that the offshore endeavor continues to be safe and sensible over time.

Partnering With Reliable Local Professionals and Advisors

Involving with local experts also facilitates smoother integration into business neighborhood, promoting connections that can lead to lasting benefits and assistance. Offshore Business Formation. They function as vital liaisons, assisting to link the void in between international organization techniques and regional assumptions, therefore decreasing disputes and misunderstandings

Furthermore, these advisors are important in navigating governmental procedures, from registration to obtaining essential authorizations. Their know-how makes sure that companies adhere to neighborhood legislations and policies, avoiding pricey legal concerns and prospective reputational damage. Hence, their function is pivotal in developing a lasting and effective offshore venture.

Verdict

In final thought, success in overseas business formation hinges on picking the right jurisdiction, comprehending lawful and tax obligation frameworks, and carrying out substantial due persistance. Thus, a well-executed offshore technique not just decreases threats but visit our website also optimizes possibilities for long-term business success.

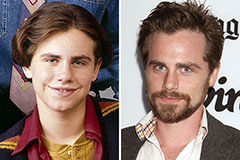

Rider Strong Then & Now!

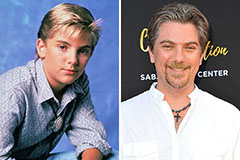

Rider Strong Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!